Register for free

Click here to pre-register to join the exciting sessions

2022 SDGs Investment Fair

The recent global socio economic crisis has thrown into sharp focus the challenges impeding the implementation of the Sustainable Development Goals (SDGs) and has corralled international discussions around how developing countries will recover some of the progress they had made; before the coronavirus pandemic and the Russian – Ukraine War, which have led to the food, energy and financial crisis across the world.

As governments work toward building back better in order to meet the 2030 deadline for the SDGs, it has become even more critical that we adopt more innovative initiatives in order to ensure resilient growth that protects countries against future shocks.

The government of Ghana, in recognition of these difficulties has chosen, as one of its initiatives, to invest in enterprise development which is critical for stimulating new employment and ultimately accelerates economic development. Through the CAP BUSS – the Coronavirus Alleviation Programme Business Support Scheme, the government set up in May 2020 a special fund to cushion micro, small and medium enterprises (MSMEs). The Ghana CARES Obaatan Pa Programme which was launched in 2021 as Government’s key recovery strategy from COVID19 has provided funding for enterprises; whilst the most recent enterprise and skills training intervention – the YouStart Programme – which is expected to be operational from September 2022, will provide funding and technical support to the youth and youth-led businesses to assist them to start, build and grow their own businesses.

What does Green Growth look like for Ghana

Ghana has committed to build the resilience of over 38 million people, generate absolute greenhouse gas emission reductions of 64 MtCO2e, create over one million jobs, avoid 2,900 deaths due to improved air quality by 2030 as part of its commitment under the Paris Agreement, which is a global framework that is focused on avoiding the dangerous climate change by limiting global warming to well below 2°C and pursuing efforts to limit it further to 1.5°C.

[Ghana aims to implement nine unconditional programmes of action that would result in 8.5 MtCO2e GHG reductions by 2025 and a further 24.6 MtCO2e by 2030 compared to the 2020-2030 cumulative emissions in a baseline scenario. Ghana can also adopt additional 25 conditional programmes of action that have the potential to achieve 16.7 MtCO2e by 2025 and 39.4 MtCO2e by 2030 if financial support from the international and private sector is made available to cover the full cost for implementation. ]

Ghana, through its Nationally Determined Contributions, has identified 19 policy areas, which will focus on 47 adaptation and mitigation programmes of action – these include replanting forests and restoring damaged ecosystems, climate resilient agriculture, the preservation of watersheds and the development of innovative solutions to manage the impacts of natural disasters, as well as developing climate resilient infrastructure.

Green Jobs

The transition to a low carbon economy provides several job and business opportunities in the energy sector, waste management, transportation, agriculture, technology and innovation amongst others.

According to the ILO, Twenty-four million new jobs will be created globally by 2030 if the right policies to promote a greener economy are put in place. The government of Ghana, in recognition of this, intends to utilize skills training and enterprise development programmes like the YouStart to provide the skills set as well as the tools set to position young people to take advantage of the opportunities in the critical sectors that must be targeted to enable us transition successfully into the low carbon economy we envisage in 2030 – Renewable energy, waste to energy, sustainable transportation, Ecosystem services – which includes developments in air and water purification, pest control, soil renewal and fertilization, innovations in farming, advanced warning systems as well as protection against extreme weather conditions.

The 2022 SDGs Investment Fair will be providing the platform for discussing enterprise development within the context of governments efforts to fulfill its obligations under the Paris Agreement as well as deliver on its 2030 Agenda in the most efficient manner possible. Providing clarity on the opportunities that have been created for private sector enterprises based on existing government policies on sustainable industries, enterprises and green project development will enable existing MSMEs adopt more environmentally responsible ways of conducting their business, and will ensure that new entrepreneurs design economically viable and environmentally responsible businesses that will facilitate government’s transition to a low carbon and resilient economy.

Theme

Investments In Green Enterprise Development the Sustainable Pathway to Climate Resilient Growth

Topics

Scaling up innovative financing for Green Enterprise Development

Date

From 8 to 9 September, 2022. Via Zoom platform

SPEAKERS & MODERATORS

The Accra SDGs Investment Fair will bring together High-Level Government Officials, Community Facilitators, Investors, Civil Society, Entrepreneurs, Knowledge Institutions and other stakeholders to help develop a sustainable network for post-COVID-19 strategies that will support the government’s vision of a Ghana Beyond Aid.

PANELISTS

Hon. Dr. John Ampontuah Kumah, the current Member of Parliament for Ejisu, in the Ashanti Region, is a Lawyer and an Entrepreneur with over fifteen …

Dr. John Kumah

Deputy Minister for Finance

Prof. George Gyan Baffour

Chairman – National Development Planning Commission

Felix Addo-Yobo

Deputy Director – SDGs Advisory Unit, Office of the President

Reginald Yofi Grant draws from over three decades of a successful career and experience in investment banking and finance as he heads…

Yofi Grant

Chief Executive Officer – GIPC

A Lawyer, Environmental Scientist and a Natural Resource Management expert, Henry Kwabena Kokofu, esq was appointed as the Executive…

Hon. Henry Kokofu

Executive Director, Environmental Protection Agency

Nigel Topping is the UK’s High-Level Climate Action Champion, appointed by the UK Prime Minister in January 2020. Mr. Topping works alongside the…

Nigel Toppings

High-Level Climate Action Champion, Glasgow Financial Alliance for Net Zero (GFANZ)

Charles Abani

UN Resident Coordinator

Genevieve is an enterprise development expert who currently works with SNV Ghana as the Senior Incubation and Acceleration Advisor on…

Genevieve Parker-Twum

Senior Incubation and Acceleration Advisor on the #GrEEnProject

Leon de Vreede (MCIP, LPP) is the Senior Policy & Program Planner for the Town of Bridgewater, Nova Scotia, where he manages policy…

Leon de Vreede

Senior Policy & Program Planner, Energize Bridgewater

Eric Affram

Head of Financial Support Services Directorate, Ghana Enterprise Agency

Normand Michaud

Director, SUNREF

Moustapha Kamal Gueye

Global Coordinator of the Green Jobs Programme, International Labour Organization (ILO)

Anshari is a Vice President in the Strategy & Development Group at GenZero, and he is responsible for providing thought leadership on policy…

Anshari Rahman

Vice President in the Strategy; Development Group, GenZero, a Singapore-based decarbonization investment platform

Ebenezer Ashie

Director, Energy Commission (Project Coordinator, SUNREF/Green Projects Financing)

Ebenezer is the founder and CEO of Wangara Green Ventures, an impact investment company in Ghana, West Africa with catalytic capital…

Ebenezer Arthur

Wangara Green Ventures

Sylvia Sefako Senu

Econonist, UNDP

Amma Lartey

Impact Investing Ghana

Rev. Isaac Adza Tetteh

Regional Economic Planning Officer, Volta Regional Coordinating Council

Thomas Peterson

Founder, President and C.E.O – Center for Climate Strategies

Mr. Alhassan Andani is a Ghanaian economist, the former president of the Ghana Association of Bankers (GAB), and the former Chief Executive of Stanbic Bank.

Alhassan Andani

Former Chief Executive of Stanbic Bank Ghana & President of the Ghana Association of Bankers (GAB)

I am a socially driven sustainability leader in the field of social and humanitarian development. I hold an MBA (General Management)…

Gifty Volimkarime

Project Director, Green Economy Ghana

Shaibu Baani Azumah is the Director of the Action for Shea Parklands initiative which will grow and protect 10 million trees by 2030

Dr. Shaibu Baanni Azumah

Director, Action for Shea Parklands, Global Shea Alliance

Angela Yayra Kwashie is the Technical Specialist (Local Government Finance) of UNCDF’s GrEEn Project…

Angela Kwashie

UNCDF

Aaron Nyarkotey is a Greentech professional. He is passionate about the development and dissemination of low carbon technologies…

Aaron Nyarkotey

Project Manager and Business Development Lead, Burn Design Lab (Ghana)

Dr Mary Owusu is the Director of the Smart Sustainable Cities and Historical Heritage Secretariat (SSCHH) headquartered in Kyebi…

Dr. Mary Owusu

Project Director, Smart Sustainable Cities and Historical Heritage – Kyebi

Dr Munro is a South African national who brings a longstanding experience in international development, local governance, and urban sustainability…

Greg Munro

Director – Cities Alliance

Fred Sabiti,

UNDP’s Technical Advisor, Ministry of Finance and Economic Planning – Rwanda

MODERATORS

Amma is CEO of Impact Investing Ghana, an initiative to mobilize $1billion in funds for impact investing in Ghana and West Africa…

Amma Lartey

A seasoned Fundraising, Enterprise Development and Events Consultant experienced in providing advice to entities including Non-profit organisations…

Mansa Ayisi-Okyere

Nana Yaw, a Principal Economist is an astute communicator with a genuine passion for achievement as a team member and a well-rounded…

Nana Yaw Yankah

Felix provides strategic leadership, technical and operational direction in Development Policy for the achievement of the mandate of the Commission…

Dr. Felix Addo-Yobo

Collins Kabuga

PROGRAMME

Outline for the 2 days virtual event

10:00

Morning Session

Panel Discussion – Town Hall | Investments In Green Enterprise Development The Sustainable Pathway To Climate Resilient Growth

Moderator: Amma Lartey, Panelists: Prof. George Gyan Baffour, Dr. Eugene Owusu, Yofi Grant, Hon. Henry Kokofu, Charles Abani

95mins

Presentation on Dealrooms

20mins

13:00

Afternoon Session

45mins

Sustainable Financing: Promoting Green Enterprise Development

Panelist: Charles Bodwell, Enterprise Development Specialist, ILO | Kosi Yankey, Chief Executive, Ghana Enterprises Agency

45mins

The transition to a low carbon economy: Green Jobs and investment Opportunities

Panelists: Moustapha Kamal Gueye, Global Coordinator of the Green Jobs Programme, International Labour Organization (ILO) | Steve Howard, Founding Chair, Chief Sustainability Officer, Temasek International (We Mean Business) | GenZero, a Singapore-based decarbonization investment platform

45min

Local level implementation of the SDGs: opportunities for Investors and Project Developers

Panelists: Sylvia Sefako Senu, Econonist, UNDP | Amma Lartey, Impact Investing Ghana | Thomas Peterson, Center for Climate Strategies

45mins

Financing Ghana’s Nationally Determined Contributions: Galvanizing Local Action and Leveraging Domestic Resources

Host: Hon. Henry Kokofu, Executive Director, Environmental Protection Agency | Panelist: Alhassan Andani, Former Chief Executive of Stanbic Bank Ghana & President of the Ghana Association of Bankers (GAB) | Fred Sabiti, UNDP's Technical Advisor, Ministry of Finance and Economic Planning - Rwanda

45mins

13:00

Afternoon Session

45min

Building Resilience and Transforming Local Economies: the Role of Green Enterprises

Moderator: Nana Yaw Yankah Panelists: Dr. Shaibu Baanni Azumah, Director, Action for Shea Parklands - Global Shea Alliance | Angela Kwashie, UNCDF | Aaron Nyarkotey, Project Manager and Business Development Lead, Burn Design Lab (Ghana)

45mins

Sustainable Cities: Best Practices and globally applicable principles for financing city wide green initiatives

Moderator: Collins Kabuga Panelists: Dr. Mary Owusu, Project Director, Smart Sustainable Cities and Historical Heritage - Kyebi | Greg Munro -Director - Cities Alliance | Leon de Vreede, Senior Policy & Program Planner, Energize Bridgewater45mins

Transitioning into a Green Enterprise – the Dos and Don’ts

Moderator: Mansa Ayisi-Okyere Panelists: Ebenezer Arthur, Wangara Green Ventures | Gifty Volimkarime, Project Director, Green Economy Ghana | Dr. George Ortsin, National Coordinator - Small Grants Programme (SGP) - UNDP

45mins

25

PANELISTS

6

MODERATORS

2

DAYS

8

TOPICS

REGISTER FOR FREE

Pre-register now to join the exciting sessions from 8-9 September 2022

PARTNERS

Ministry of Finance, SDG Advisory Unit-Office of the President, Ghana Investment Promotion Centre (GIPC), Social Enterprise Ghana and Impact Investing Ghana

[/vc_section]

PAST EVENTS

Virtual 2021 Accra SDGs Investment Fair

The COVID-19 pandemic has exposed the response capacities of countries and highlighted the need to do better in the future. As countries struggle to respond to the pandemic and formulate their Covid-19 exit and recovery strate- gies to emerge stronger, there are looming questions around which parts of “business-as-usual” are worth return- ing to and which will require radical transformation to deliver long-term resilience.

To recover and build back better, most countries acknowledge there’s no magic bullet or one-size-Jts all policy for mitigating the eKects of the pandemic. However, there is a general consensus that an integrated approach rather than a stream of single initiatives is required. That is a policy framework that connects all the diKerent parts of the system and provides an aligned plan of action that everyone can buy into and support.

Government in November 2020 launched the GH¢100 billion Ghana CARES Obaatanpa Programme to mitigate the negative impact of the COVID-19 pandemic and return the economy to a path of robust and sustainable growth over the next 3 years. A bulk of this amount, GH¢70 billion is expected to come from the private sector through For- eign Direct Investments and Public Private Partnerships.

In view of this, the CARES “Obaatanpa” programme provides a mechanism to consolidate private sector investment into productive sectors of the economy to create a dynamic regional economy for Ghana. SpeciJc measures to be implemented include Business and Regulatory Reforms (BRR), digitization to improve the quality and transparency of public service delivery, expansion of access to Jnance for Ghanaian businesses, skills training and retraining, sup- port to SMEs, and energy sector reform.

This session would discuss;

- Leveraging public and private innovative digital solutions to improve quality and efficiency of services;

- Incentivizing private sector participation in the implementation of the CARES Programme;

- Strengthening the legal and regulatory environment to support realisation of the “Obaatanpa” Programme.

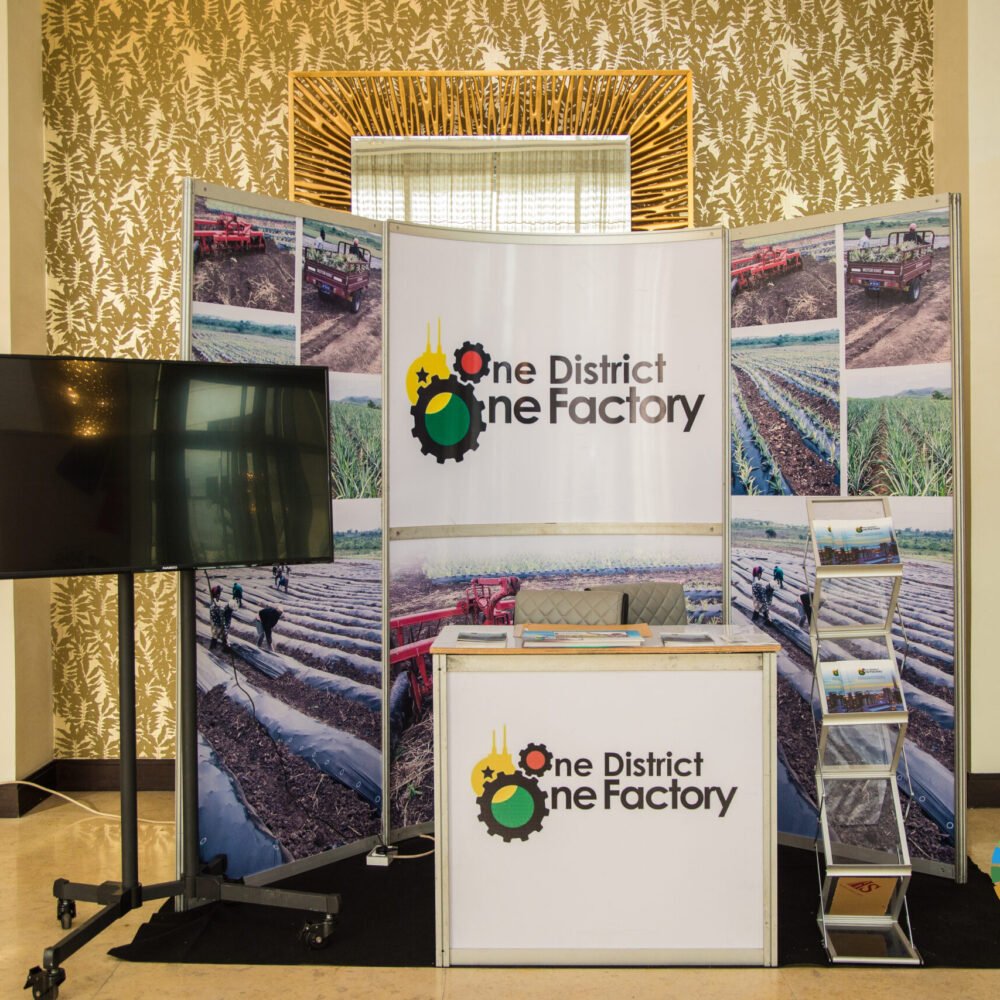

VIRTUAL EXHIBITION

The Accra SDGs Investment Fair provides a platform to showcase investment opportunities with strong impact

potential across key sectors.

A video exhibition showcasing impact ventures whose products or services address key SDGs will run throughout the programme with a final exhibition showcase on the 26th.

An online brochure listing the contact information, products and services of the entrepreneurs is available for

download. Click on the button below to download.

[/vc_section]

[/vc_section]

PROGRAMME

Outline for the 3 days virtual event

10:00

Morning Session

Panel Discussion – Town Hall | Investments In Green Enterprise Development The Sustainable Pathway To Climate Resilient Growth

Moderator: Amma Lartey, Panelists: Prof. George Gyan Baffour, Dr. Eugene Owusu, Yofi Grant, Hon. Henry Kokofu, Charles Abani

95mins

Presentation on Dealrooms

20mins

13:00

Afternoon Session

45mins

Sustainable Financing: Promoting Green Enterprise Development

Panelist: Charles Bodwell, Enterprise Development Specialist, ILO | Kosi Yankey, Chief Executive, Ghana Enterprises Agency

45mins

The transition to a low carbon economy: Green Jobs and investment Opportunities

Panelists: Moustapha Kamal Gueye, Global Coordinator of the Green Jobs Programme, International Labour Organization (ILO) | Steve Howard, Founding Chair, Chief Sustainability Officer, Temasek International (We Mean Business) | GenZero, a Singapore-based decarbonization investment platform

45min

Local level implementation of the SDGs: opportunities for Investors and Project Developers

Panelists: Sylvia Sefako Senu, Econonist, UNDP | Amma Lartey, Impact Investing Ghana | Thomas Peterson, Center for Climate Strategies

45mins

Financing Ghana’s Nationally Determined Contributions: Galvanizing Local Action and Leveraging Domestic Resources

Host: Hon. Henry Kokofu, Executive Director, Environmental Protection Agency | Panelist: Alhassan Andani, Former Chief Executive of Stanbic Bank Ghana & President of the Ghana Association of Bankers (GAB) | Fred Sabiti, UNDP's Technical Advisor, Ministry of Finance and Economic Planning - Rwanda

45mins

13:00

Afternoon Session

45min

Building Resilience and Transforming Local Economies: the Role of Green Enterprises

Moderator: Nana Yaw Yankah Panelists: Dr. Shaibu Baanni Azumah, Director, Action for Shea Parklands - Global Shea Alliance | Angela Kwashie, UNCDF | Aaron Nyarkotey, Project Manager and Business Development Lead, Burn Design Lab (Ghana)

45mins

Sustainable Cities: Best Practices and globally applicable principles for financing city wide green initiatives

Moderator: Collins Kabuga Panelists: Dr. Mary Owusu, Project Director, Smart Sustainable Cities and Historical Heritage - Kyebi | Greg Munro -Director - Cities Alliance | Leon de Vreede, Senior Policy & Program Planner, Energize Bridgewater45mins

Transitioning into a Green Enterprise – the Dos and Don’ts

Moderator: Mansa Ayisi-Okyere Panelists: Ebenezer Arthur, Wangara Green Ventures | Gifty Volimkarime, Project Director, Green Economy Ghana | Dr. George Ortsin, National Coordinator - Small Grants Programme (SGP) - UNDP

45mins

PAST EVENTS

TOPICS

The era of Vaccine Nationalism; Lessons for African Leaders and the Business Community.

The COVID-19 pandemic has exposed the fragility of health systems and highlighted the urgent need to invest in robust health systems as well as ensuring adequate level of security of supply of health products in the region through effective public health policy responses.

As of 10th August, 2021, the confirmed Covid-19 cases and deaths on the continent stood at 5,156,935 and 124,020 respectively, and it is estimated that 39 million Africans could be pushed into extreme poverty in 2021 (AfDB 2021 AEO). We are also witnessing the worst employment crisis in living history, the International Labour Organization (ILO) estimates that 114 million jobs were lost globally in 2020.

The World Health Organisation (WHO) has further raised concerns about “vaccine nationalism”, where wealthy nations are hoarding vaccines. This could increase the risk of the coronavirus mutating further, in the absence of universal access to the vaccines, especially to vulnerable regions.

Vaccine coverage rates in Africa remain well below two percent (2%), whilst those of developed nations have achieved seventy percent (70%) herd immunity coverage in short order, with others having more than quadruple their vaccine need.

The continent currently bears 24 percent of the global burden of diseases, although it holds only about 15 percent of the world’s population, and the burden of disease is projected to rise by 28 percent in 2030. Sadly though, there are only 6 African countries with very infantile human vaccine production capacity. These are; Senegal: producer of prequalified vaccine (yellow fever), Egypt: Diptheria, Tetanus toxoids and Pertussis (DTP) and some fill finish, South Africa: Fill finish, Tunisia: very limited Bacillus Calmette–Guérin (BCG) vaccine primarily used against tuberculosis and rabies, and Ethiopia: starting.

There continues to be strong advocacy for voluntary licensing, waiver of intellectual property and technology transfer to boost regional capacity for vaccine production and increase the flow of badly-needed vaccines to more vulnerable regions in order to bridge the startling divide in fighting COVID-19 as captured in the Rome Declaration of the Global Health Summit on May 21st, 2021.

This session will discuss;

- What African Governments should do to upend vaccine nationalism?

- How African Governments can partner with big pharma and the private sector to develop local vaccine manufacturing capacity?

- Whether African countries have the “base capacity” to be leveraged for vaccines production? What other socio-economic factors can be levers to attract investments in vaccine production?

Building back better through the Ghana CARES Obaatanpa Programme

The COVID-19 pandemic has exposed the response capacities of countries and highlighted the need to do better in the future. As countries struggle to respond to the pandemic and formulate their Covid-19 exit and recovery strategies to emerge stronger, there are looming questions around which parts of “business-as-usual” are worth returning to and which will require radical transformation to deliver long-term resilience.

To recover and build back better, most countries acknowledge there’s no magic bullet or one-size-fits all policy for mitigating the effects of the pandemic. However, there is a general consensus that an integrated approach rather than a stream of single initiatives is required. That is a policy framework that connects all the different parts of the system and provides an aligned plan of action that everyone can buy into and support.

Government in November 2020 launched the GH¢100 billion Ghana CARES Obaatanpa Programme to mitigate the negative impact of the COVID-19 pandemic and return the economy to a path of robust and sustainable growth over the next 3 years. A bulk of this amount, GH¢70 billion is expected to come from the private sector through Foreign Direct Investments and Public Private Partnerships.

In view of this, the CARES “Obaatanpa” programme provides a mechanism to consolidate private sector investment into productive sectors of the economy to create a dynamic regional economy for Ghana. Specific measures to be implemented include Business and Regulatory Reforms (BRR), digitization to improve the quality and transparency of public service delivery, expansion of access to finance for Ghanaian businesses, skills training and retraining, support to SMEs, and energy sector reform.

This session would discuss;

- Leveraging public and private innovative digital solutions to improve quality and efficiency of services;

- Incentivizing private sector participation in the implementation of the CARES Programme;

- Strengthening the legal and regulatory environment to support realisation of the “Obaatanpa” Programme.

Business Opportunities for MSMEs in the Pandemic Era : Business Continuity and Building Resilience in the Era of the Pandemic

Consequent to the Covid-19 pandemic, many businesses, especially small ones and start-ups have suffered major setbacks. Some have folded up as operations stalled with the closure of borders, coupled with import/export associated delays, lack of turnaround capital, inactive clientele, etc.

Government, through the erstwhile National Board for Small Scale Industries (NBSSI) (now Ghana Enterprises Agencies) under the Covid-19 Emergency Relief Fund and the NBSSI/Mastercard Foundation Covid-19 Recovery and Resilience Program, implemented a number of interventions to reduce the impact of the pandemic on businesses. However, these interventions could not cover all affected companies. In the private sector space, some companies survived the heat narrowly while others divested. The place of business continuity plans, as a mitigation factor against the impact of disasters such as Covid-19 cannot be overemphasized.

Business continuity has been largely defined as “an organization’s ability to ensure operations and core business functions are not severely impacted by a disaster or unplanned incident that take critical systems offline”, or in the case of a global health pandemic, that take critical systems online.

This session will discuss;

- Some business tools and strategies needed to maintain an organization’s resilience in responding quickly to major setbacks;

- Government plans towards supporting MSMEs in these spaces;

- Success stories from striving companies.

The AfCFTA: Potential Source of Sustainable Financing for the SDGs on the Continent

- Creating synergies for learning and networking through existing AfCFTA and the SDGs platforms.

- Tackling issues of weak governance to raise additional domestic resources to finance the Continents SDGs investment gap.

Impact Of Digitalization On Businesses and Financiers

The concept of transformation in digital approaches and systems through the use of digital technologies in a strategic manner that streamlines and accelerates business operations has increased in recent times. Digitization of businesses not only promotes increases in revenue for businesses but also enhances customer experience and gaining a competitive edge for financiers of businesses.

Three key enablers have been identified as crucial for the desired impact of digitalization on businesses and financiers. They include: technology (the potential benefits on operations, as well as ease of its integration); demand (customer experience that is direct and spontaneous); and behavior (consumer expectations with regards to the use of integrated technology).

The impact of digitalization on businesses and financiers may differ, however, it should positively influence businesses and financiers in areas of increased revenue, decreased operating costs, improved customer satisfaction, lowered fragmentation, optimized operations, among others. Ghana’s digitalization agenda has over the past years received enormous support at the highest level, and lessons from the emergence of the Covid-19 pandemic has facilitated the realization of the vital role it plays in driving and sustaining long-term economic growth.

Conscious of the importance of digitalization to economic productivity and service delivery, Government under its Obaatanpa programme intends to expedite implementation of its digital initiatives such as National I.D, digital address systems, land records digitization e.t.c

This session would discuss;

- How digital transformation can help business improve on their operational activities;

- Opportunities of digitalization for financiers and businesses in building back better (effect of digitalization on knowledge management);

- Avenues for improving and facilitating better exchange of information between businesses, financiers and tech-entrepreneurs and ways of creating synergies;

- Challenges of digitalization and sectors where digitalization can be best employed.

Optimizing Ghana’s Agricultural Value Chain: Opportunities For Young Entrepreneurs

In developing countries with annual per capita incomes ranging from $400 to $1,800, agriculture continues to play a significant role in the employment of about 40 percent of the total labor force. Developing countries will continue to rely heavily on the agricultural sector to ensure employment for the rural poor and food security for growing populations as well as to meet challenges brought on by climate change and spikes in global food prices.

Globalization, coupled with growing middle and high income classes continue to offer opportunities for developing country producers to operate in emerging national and international markets. Value chains, often controlled by multinational or national firms and supermarkets, are capturing a growing share of the agri-food systems in developing regions. These value chains are designed to increase competitive advantage through collaboration in a venture that links producers, processors, marketers, food service companies, retailers and supporting groups such as shippers, research groups and suppliers.

Government has in recent times implemented interventions that seek to support the scaling up of agricultural value chains by linking small scale farmers to markets, finance, inputs, equipment and information through large commercial farmers and traders who have the capacity and incentives to invest in smallholder production.

The business communities involved in the agriculture and agribusiness sectors have recently experienced a tremendous resurgence of interest in promoting value chains as a way to add value, diversify rural economies, and contribute to increasing rural household disposable incomes. Value chains are increasingly recognized as a means to tap into new sources of potential growth and value addition in the sector. Hopefully, renewed engagement will lead to a substantial increase in the flow of financial resources and assistance that is dedicated to supporting market sustainable agro-enterprises and agricultural value chains throughout the Agri-Sector.

This session has the objective to explore opportunities in the agricultural value chain that can be harnessed by the youth.

The session will discuss;

- How local producers can become more efficient in value addition to raw produce and how they can collaborate with parties in value chains to enable them capture new market opportunities;

- What business environment needs to be created and requirements on government to enable local entrepreneurs in the Agriculture Sector take advantage of growth opportunities across the globe;

- What major upgrading opportunities are available and which parties are most suited to facilitate value chain upgrading in Ghana.

- How digitisation initiatives are enhancing Ghana’s Agricultural Value Chain.

Ghana’s Pharmaceutical Industry - The Role Of The Private Sector In Vaccine Development

The global stampede and scramble for the acquisition of Covid-19 vaccines and other essential medicines has inadvertently demonstrated that the security of our health sector is intrinsically linked to the robustness of the pharmaceutical industry.

Ghana’s pharmaceutical market is amongst the largest in West Africa, valued at almost Ghc 3.7 billion (US$ 616 million) in 2020 and projected to US$ 941 million by 2024, at the compound annual growth rate (CAGR) of 9.8%1. By global and even regional standards, this is still a fairly modest market and is one of the most attractive pharmaceutical markets in West Africa.

Ghana’s pharmaceutical industry is largely dominated by 62 Indian companies and about 30 local companies. The industry is also highly dependent on pharmaceutical imports. The Ghana Health Service estimates that only 30% of the national pharmaceutical products requirements are produced locally. However, most of the local pharmaceutical giants such as Ernest Chemist, Tobinco Pharmaceuticals and Dannex Ayrton Starwin Plc have export presence in the West African region and are gaining support towards achieving WHO qualification and Good Manufacturing Practices (GMP) certification.

Ghana spends about 7% of GDP on average on the healthcare sector. These are mainly expenditures on staff compensation, training, equipment and infrastructure development, procurement, supply and management of essential medicines, and enhanced health Management Information Systems.

Ghana has been dependent on the GAVI Alliance for financial support for childhood and related routine vaccinations for the past two decades. Currently, GAVI supports over 80% of the cost of vaccines and their delivery, including health systems strengthening. With limited Government’s resources, there is a growing scope of participation by the private sector entities who are making investments in the construction, management, consultancy, and financing aspects of health care.

The Covid-19 pandemic compelled the local pharmaceutical industry to scale the production of some essential and recommended medicines, personal care products, and hand sanitizers for management of the pandemic in Ghana. However, like many African countries, Ghana does not currently have the capacity to produce vaccines and is vulnerable to shortages and attendant challenges. In keeping with Government’s aspirations of establishing a covid-19 vaccine manufacturing plant in Ghana, H. E the President has constituted an inter-agency taskforce to explore Public-Private collaborations towards achieving self-sufficiency in vaccine production to meet national and regional needs.

This session would discuss;

- What are the practical approaches to mobilizing support for the implementation of the WHO Trade-Related Aspects of Intellectual Property Rights Flexibilities?

- Does Ghana have immediate term capacity to begin general vaccine development and production?

- What framework and ecosystem should the Government put in place to accelerate aspirations of vaccine self-sufficiency for Ghana and the region?

Investment Opportunities for Private Sector Participation in Ghana’s Nationally Determined Contributions (NDCs)

Since the Paris Agreement was adopted in December 2015, over 150 countries have submitted national plans which target aggressive growth in climate solutions—including renewable energy, low-carbon cities, energy efficiency, sustainable forest management, and climate-smart agriculture. These plans, known as Nationally Determined Contributions (NDCs), are expected to offer a clear direction for investments that will target climate-resilient infrastructure and offset higher upfront costs through efficiency gains and fuel savings.

Again, NDCs are intended to be a way to clarify how each Party to the United Nations Framework Convention on Climate Change (UNFCCC) could contribute to averting dangerous climate change and demonstrate progress from their current position. NDCs therefore, could potentially be a way in which all countries can make concerted efforts to build strong and transparent domestic foundations upon which to pursue a path to decarbonisation and enable them to set higher ambitions, post Paris

Along with the opportunity created by the Paris Agreement came an important challenge of transforming NDCs into tangible actions that lead to long term zero-carbon and climate-resilient development. It is recognised that access to finance is fundamental for creating momentum and raising ambition, but countries continue to face challenges in securing financial resources and attracting private sector investment at the scale needed to achieve their NDCs targets.

This session would discuss;

- How can the private sector be crowded in to directly connect Ghana’s NDCs investment priorities with financing and technology?

- What factors are limiting private sector involvement in financing Ghana’s NDCs;

- Are there Government incentives or an enabling environment for the private sector in the implementation of the NDCs?

Financing a National Pandemic Preparedness Strategy for Future Pandemics: The Role of Public Private Partnerships (PPP)

Few natural perils threaten more loss of lives, economic disruption, and social disorder than large-scale disease outbreaks. For the past years, there have been records of outbreaks and pandemics that have affected a lot of lives and economies globally. The high death count and social disruption are not the only costs associated with pandemics; the financial and economic damages are also devastating.

Pandemics are inevitable and probably imminent and very devastating to a country’s health, its economy and strategic interests. The coronavirus pandemic is a vivid and painful example of a devastation that has affected millions of lives globally and has had negative impacts on various economies around the world.

Global estimates indicate the virus reduced global economic growth in 2020 to an annualized rate of -3.4% to -7.6%, with a recovery of 4.2% to 5.6% projected for 2021. Global trade is estimated to have fallen by 5.3% in 2020, but is projected to grow by 8.0% in 2021 according to the World Health Organization (WHO). Due to the pandemic, Ghana lost $171 million in the tourism and hospitality industry. The healthcare system has been affected due to the overload on the health delivery system. Some businesses collapsed because of low sales and some could not meet their expected margin. All these are losses that have impacted Ghana’s economy.

Financing recovery will require the government seeking private sector support in infrastructure projects delivery as well as attracting private sector participation and funding to reduce the already stretched public finances.

The session will discuss;

- leveraging private sector assets and capacities in the development of national plans for preparedness ;

- Efforts at improving the enabling environment for increased PPP investments;

- Incentivising private sector led solutions that are non proprietary / open sourced;

Resource Persons

Prof Gyan Baffour

Rep from the Ghana Health Service

Mr. Collison, Director, Public Investments and Assets Division (PIAD) (Ministry of Finance)

Mr. Kumah Aboagye, Ministry of Health (MoH)

AGI

Health and Wellbeing: Entrepreneurship Opportunities in the Complementary and Alternative Medicine Industry

The global complementary and alternative medicine market report in 2020 valued the industry at about US$ 82 billion with a potential to increase depending on investments made into the industry. The impact of the COVID-19 pandemic and the already high demand for complementary and alternative medicines across developing countries and Asia have been identified as the two major driving forces of the market.

The market is expected to rapidly expand on the back of changing regulatory scenarios and robust government initiatives. The Middle East and Africa is expected to expand fastest at 24.78 percent from 2021 to 2028 based on the significant number of alternative medicine practitioners witnessed.

In Ghana, available evidence indicates that about 70 percent of the populace depend on complementary and alternative medicines for their health needs. In recognition of this, the Government in September 2012 integrated alternative medicine into the formal health care delivery system. Ghana stands tall in alternative medicine within the sub-region, however there are some bottlenecks in the delivery, policy and practice space. Addressing these challenges holds promising opportunities for job creation by micro entrepreneurs across the traditional medicine value chain in Ghana, Africa and the world.

This session would discuss;

- The impact of COVID-19 Pandemic on complementary and alternative medicine industry growth in Ghana

- Key opportunities entrepreneurs can count on during the current pandemic and beyond

- Growth potential and niche segments for Ghana in the sub-region

The main driving forces responsible for transforming the trajectory of the industry